Why Vintage Watches Are a Good Investment

Vintage watches are becoming increasingly popular among investors looking to diversify their portfolios. Vintage timepieces offer a unique opportunity to acquire a piece of history, often at surprisingly affordable prices. Moreover, vintage watches have proven wise investments in the long run, as many models appreciate in value significantly over time. In this article, we will explore why vintage watches make a great investment and the key factors to consider when investing in them.

Reasons To Invest in Vintage Watches

The most obvious reason to invest in vintage watches is their potential for appreciation. Many vintage timepieces have increased significantly in value over the years, making them an excellent long-term investment. Additionally, they are often less volatile than traditional investments like stocks and bonds, which can be beneficial if you’re looking for a more conservative approach to investing.

Vintage watches can also be a great way to diversify your portfolio, as they offer something different than the more traditional investments. Many watch enthusiasts are drawn to them for both their aesthetics and historical significance.

What Makes Vintage Watches Valuable

All antique and vintage pieces go in and out of fashion, and their values fluctuate accordingly. The value of vintage watches is determined by a variety of factors. Look into the following things to determine if a vintage watch might be a good investment that will hold or even increase its value over time.

Age and Condition

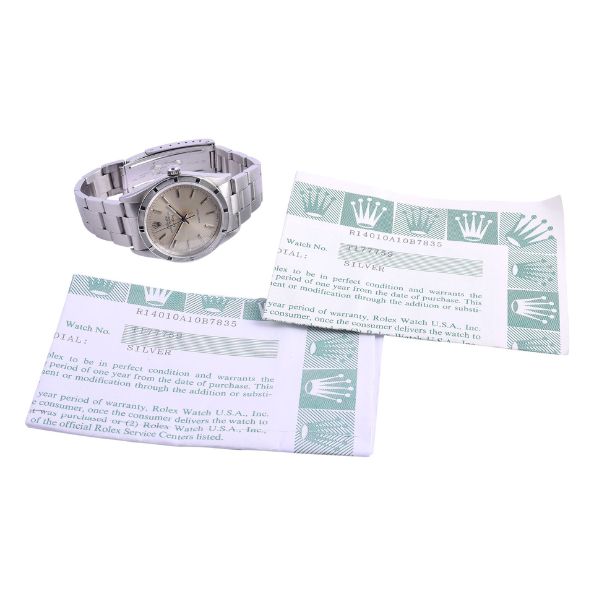

The condition of the watch is also important, as a good-condition timepiece will be more valuable than one that has seen wear and tear over the years. You can assess the condition by looking at the case, dial, movement, and bracelet or strap. Original parts are also highly sought-after and can significantly add to the value of a timepiece.

Brand and Model

The brand and model of a watch are also important when assessing its value. For instance, Rolex, Omega, and Patek Philippe are some of the most iconic luxury watch brands with long traditions of quality craftsmanship. Watches from these brands tend to hold their value better and appreciate faster than other brands.

Historical Significance or Backstory

A watch’s historical significance or backstory can also influence its value. For example, a watch that belonged to a famous person or was used in an important event will likely be more valuable than similar watches without the same history.

Scarcity

Another factor to consider is the watch’s scarcity. The rarer a model, the higher its value will be. Limited edition watches are often highly sought after and can fetch a premium.

Vintage watches are increasing in popularity with investors for their potential for appreciation, low volatility, and ability to diversify a portfolio. Determining whether a vintage watch is a good investment involves considering its age, condition, brand, model, and historical significance of the watch. When you keep these factors in mind, vintage watches can be an excellent long-term investment.